Heartwarming Tips About How To Reduce Tax Debt

You can submit payment plan applications using the irs online payment agreement tool.

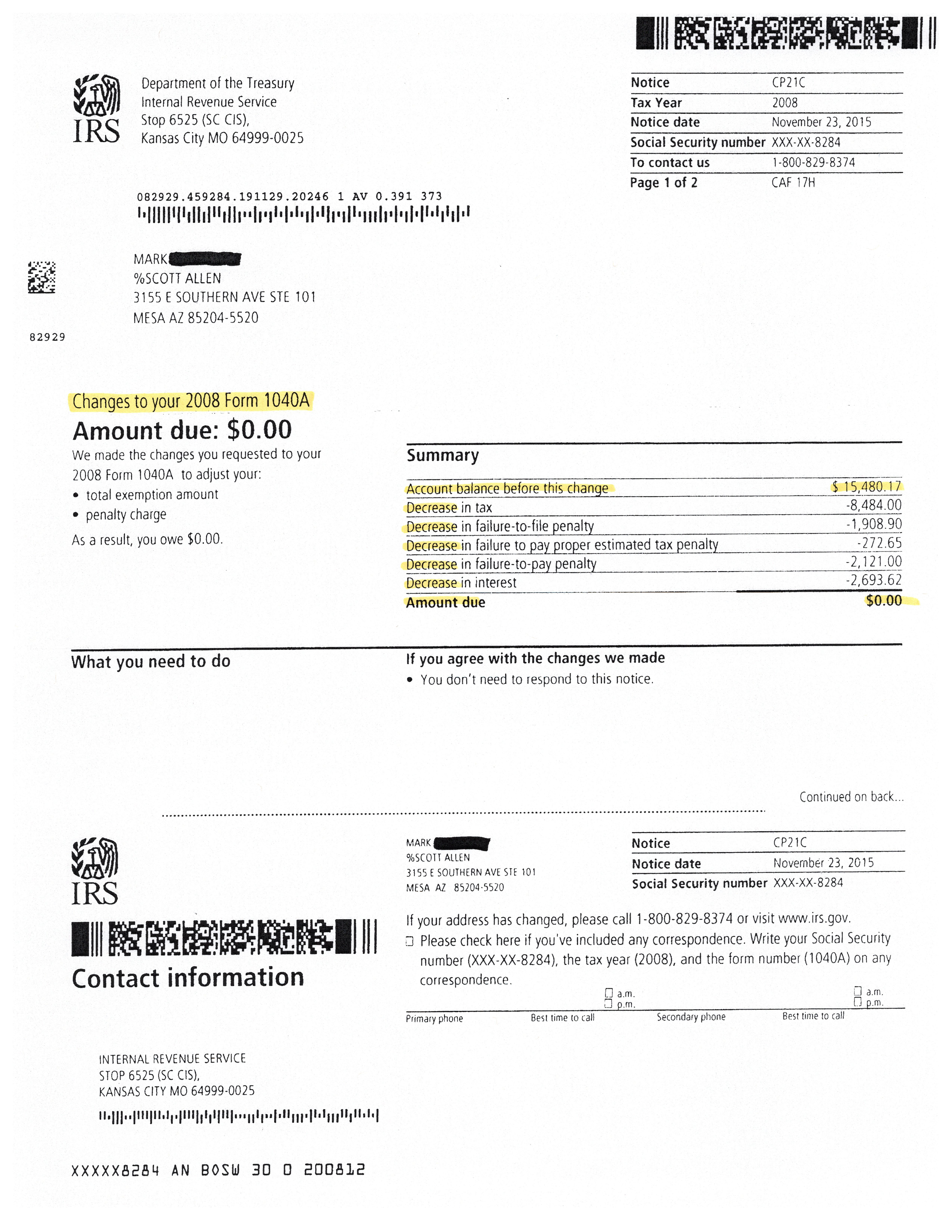

How to reduce tax debt. The first approach discussed involves filing amended returns if there were mistakes made or missed. Today, president biden announced the approval of $1.2 billion in student debt cancellation for almost 153,000 borrowers currently enrolled in the saving on a valuable. Here are the steps:

Lump sum offer: Generally, you’ll be required to pay 20 percent of the total amount you’re offering when you submit the offer. 1 turbotax deluxe learn more on intuit's website federal filing fee $42.95 state filing fee $39.95 2 taxslayer premium learn more on taxslayer's website.

In 2021, karen tongson, a professor at the university of southern california, got her debt forgiven and was refunded $20,000 by the education dept. For example, if you worked 40 hours from home a month for nine months, 60 hours for two months and a whopping 110 hours. Even with the 2017 tax cuts, total taxes have increased from $3.3 trillion in 2017 to $4.9 trillion in 2024, a 33% increase.

Learn how to resolve your tax bill if you can't pay it in full or in full and on time. When you write off bad debt, you can claim a tax deduction for the amount of the debt that is deemed. Claiming tax deductions and credits is the easiest way to lower your federal income tax bill.

Interest earned on your savings is classified as earned income by the irs. That limit also includes your employer's. Mind you… there are legitimate tax.

Ireland’s debt exploded during the financial crash, due to the hole which emerged in the public finances as tax revenues collapsed and the cost. The irs offers options such as payment plans, offers in compromise, installment. The most common way to get rid of your tax debt is with an irs payment plan.

The truth is third parties can't always deliver on claims to reduce tax debt and obtain waivers of penalties and interest. Bad debt can affect your business taxes in several ways. This article will provide an overview of various tips for reducing tax debt.

The irs has expanded and modified its collection. Taxes and reducing debt video: Find out the eligibility, payment options, process,.

For those with existing debts, using your tax refund to pay down balances can be a smart move. Taxes personal finance money home irs offer in compromise: The irs offers two options:

This can be an ideal tax reduction strategy if your income turned out to be more than expected for the year and might have pushed you into a higher tax bracket. Learn how to apply for an offer in compromise to reduce your tax liability if you can't pay in full or it creates a hardship. This is the easiest way to apply.

:max_bytes(150000):strip_icc()/digging-out-of-debt_final-b14f7e15866443b3a3b87745ea178ef8.png)