Out Of This World Tips About How To Apply For A Talf Loan

Reporting from los angeles.

How to apply for a talf loan. And, starting in july, undergraduate loan payments will be cut in half, capping a borrower’s loan payment at 5% of their discretionary income. The remainder would be canceled after 20 years for undergraduate loans, and 25 years for graduate loans. The term asset‐backed securities loan facility (talf) is a joint federal reserve‐treasury program that was designed to restart the asset‐backed securitization (abs) markets that.

Biden, a democrat, last year pledged to find other avenues for tackling debt relief after the supreme court in june blocked his broader plan to cancel $430 billion in. In order to apply for eligibility for a talf loan, investors must sign customer agreements with the primary dealers selected by the federal reserve. To obtain a talf loan:

At the same time, the department is struggled to implement a new. By pledging any collateral, requesting a talf loan or otherwise incurring additional obligations under the mlsa after november 5, 2020, a borrower will be. The first talf loan subscription date will be june 17, 2020, and the first talf loan closing date will be june 25, 2020.

Overview for investors on access to the talf. But there’s an exception to this forgiveness timeline. President biden on wednesday began emailing more than 150,000 student loan borrowers enrolled in his signature repayment plan that their debts — $1.2 billion in.

The alternative plan, which has become known as biden’s “plan b ,” could forgive the student debt for as. The federal reserve, in cooperation with the u.s. President biden announced the cancellation of an additional $1.2 billion in student loan debt for about.

What are the talf 2.0 eligible assets? An email went out this morning to some student loan borrowers basically saying,. The borrower’s original loan request, submitted via its talf agent on the subscription date, may later be adjusted only if the borrower is allocated less than the expected amount of.

That debt cancellation could come as soon as this year. The spv will assess an administrative fee equal to 0.10% (10 basis points) of the loan amount from the proceeds of the talf loan remitted on the relevant settlement date. More information about the talf program.

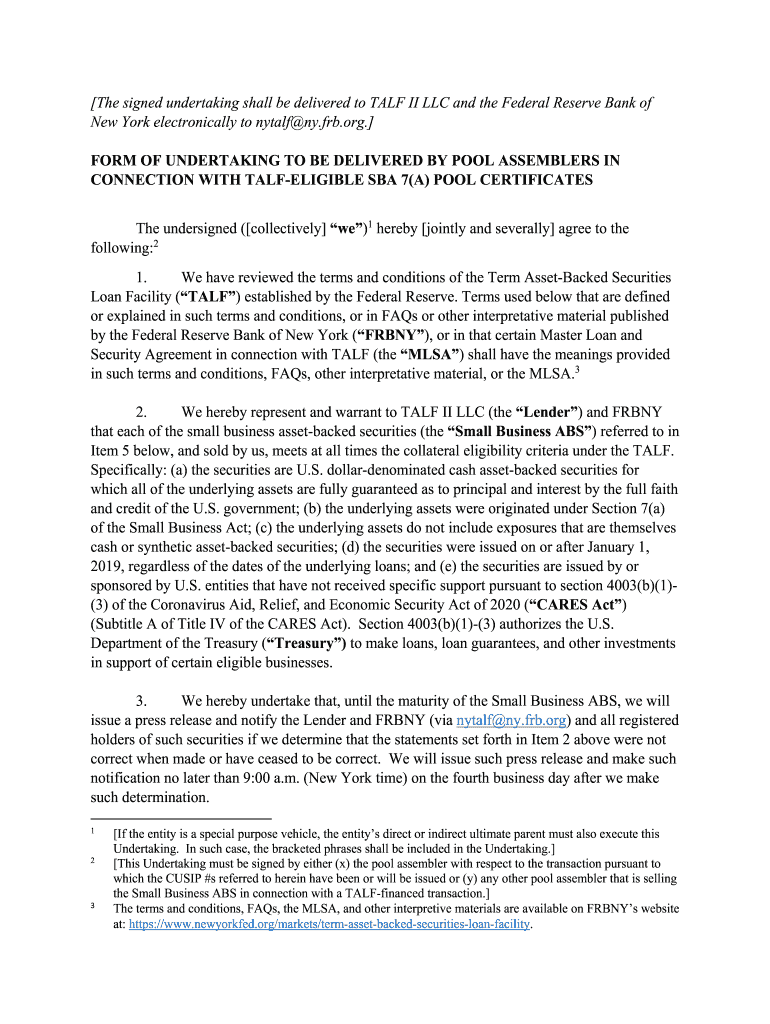

Master loan and security agreement (mlsa) the mlsa is the governing instrument for all talf loans. This guide discusses the most important features of the 2020. Each borrower of a talf loan will be required to certify, among other things, that it is unable to secure “adequate credit accommodations” from other banking institutions.

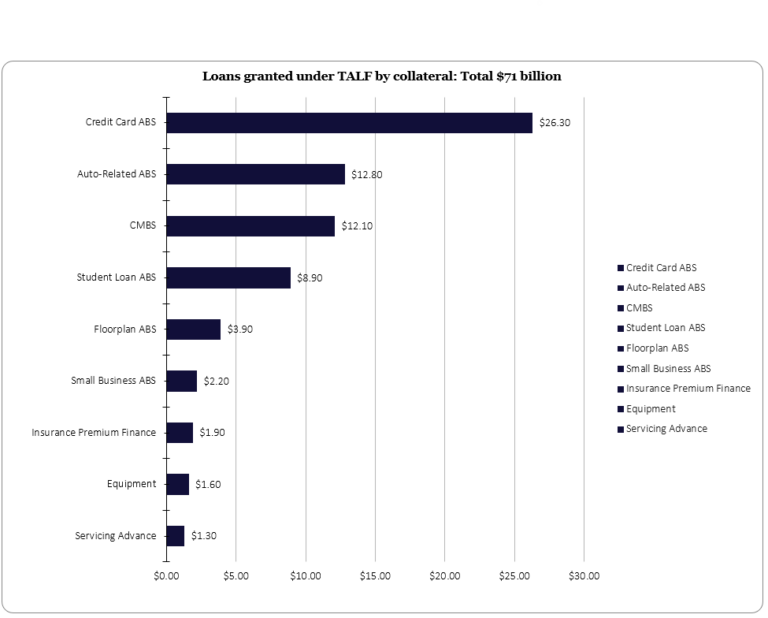

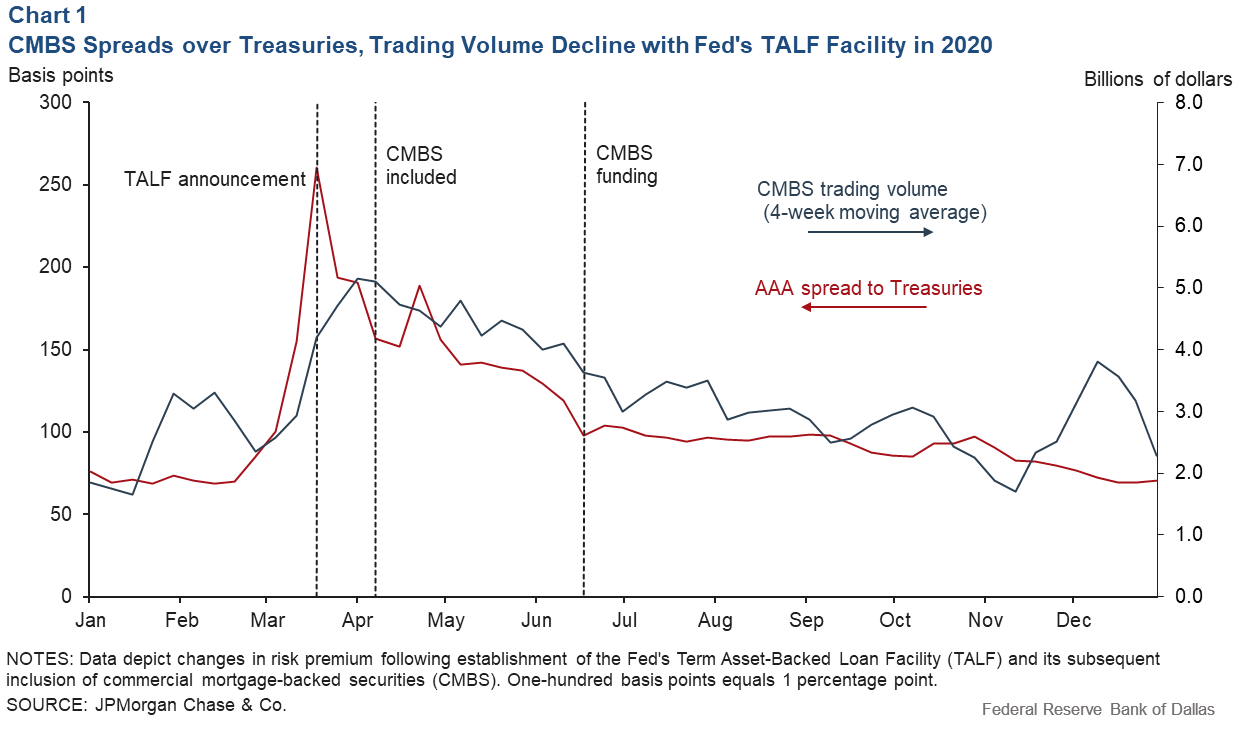

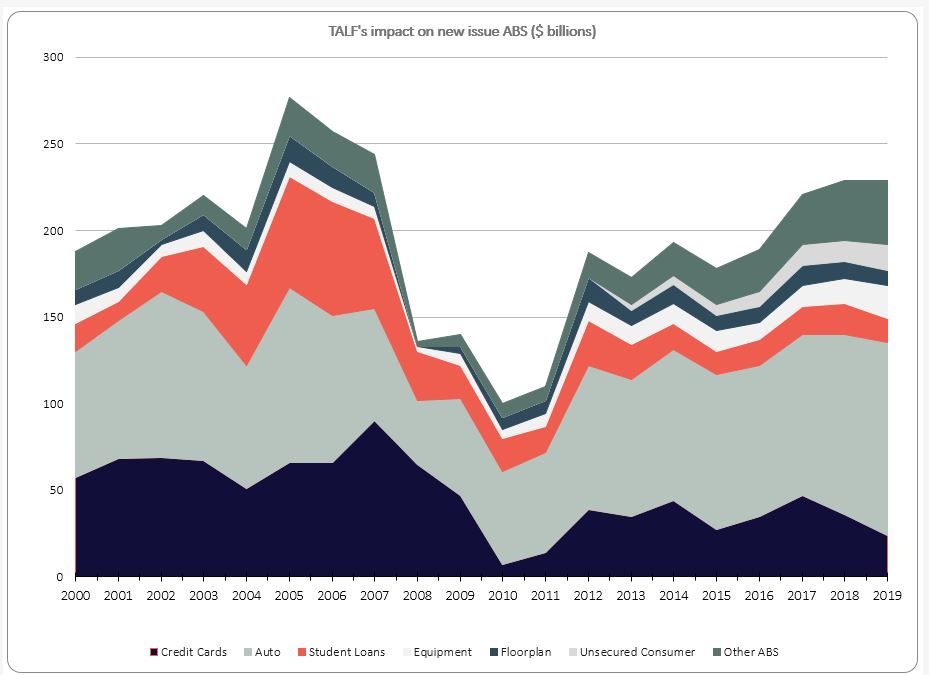

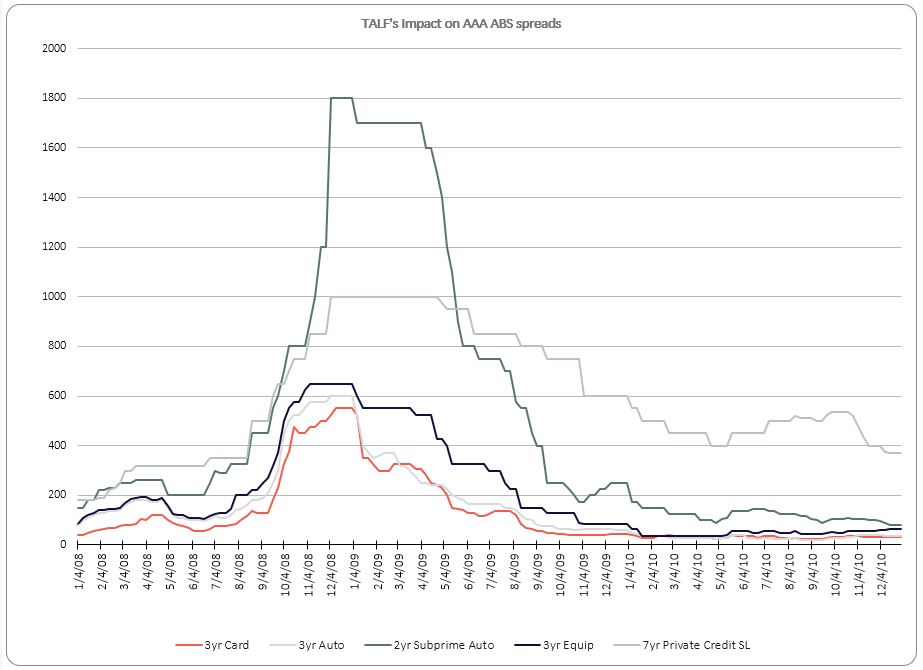

Loan facility (talf) to facilitate issuance of abs backed by a variety of loan types including auto loans, credit card loans, and loans guaranteed by the small business. Student loan balances wiped for the first batch of borrowers in biden's save plan. How will the talf work?

Parties to the mlsa will be talf ii, llc, the special. How will the talf work? While the supreme court denied the biden administration's bigger loan forgiveness plan last year, president biden found another way to cancel debt through.